In the ever-evolving landscape of technology, Samsung Electronics, a titan in the realm of memory chip production, faces turbulent times. Market dynamics and global economic shifts have coerced the company into a significant move—a drastic reduction in memory chip output.

A Turbulent Forecast for Samsung

Samsung Electronics recently estimated a staggering 96% decline in its quarterly operating profit, signaling a substantial downturn in the chip-making industry. This plummet was attributed to a drastic fall in sales, a consequence of the sluggish global economy compounded by diminished demand following the aftermath of the Covid-19 pandemic.

The Impact of Shifting Market Demand

The preliminary data divulged by Samsung reveals a startling decline in operating profits from 14 trillion won to 600 billion won in the January-March period. This reduction is a stark reminder of the industry's susceptibility to external market forces and the fluctuating demands of end products reliant on memory chips.

Covid's Impact on Demand and Production

During the pandemic, the demand for memory chips surged as people globally sought new electronics for home use. However, the subsequent slowdown in the overall economy led to a sudden drop in demand for these end products. Consequently, manufacturers halted chip orders, preferring to deplete existing inventories rather than procure new stock.

Analyst Insights into the Semiconductor Market

Noted analyst Peter Hanbury from Bain & Company referred to this phenomenon as a 'bullwhip' effect, where the sudden drought in demand after a chip shortage had a cascading impact on semiconductor manufacturers. This imbalance between inventory and demand has proven to be a challenge for various players in the industry.

Samsung's Strategic Moves

Unlike its competitors, Samsung initially resisted the reduction in memory chip production. However, facing losses in DRAM and NAND, and the need to update their factory processes due to falling behind, the conglomerate opted for the necessary cutback.

Market Speculation and Recovery Prospects

Investors, nevertheless, remain optimistic, considering Samsung's decision as a possible indicator of recovery within the semiconductor market. Industry experts anticipate a period of inventory 'digestion' over the next 3-6 months, which could potentially normalize the market's purchasing patterns.

Conclusion

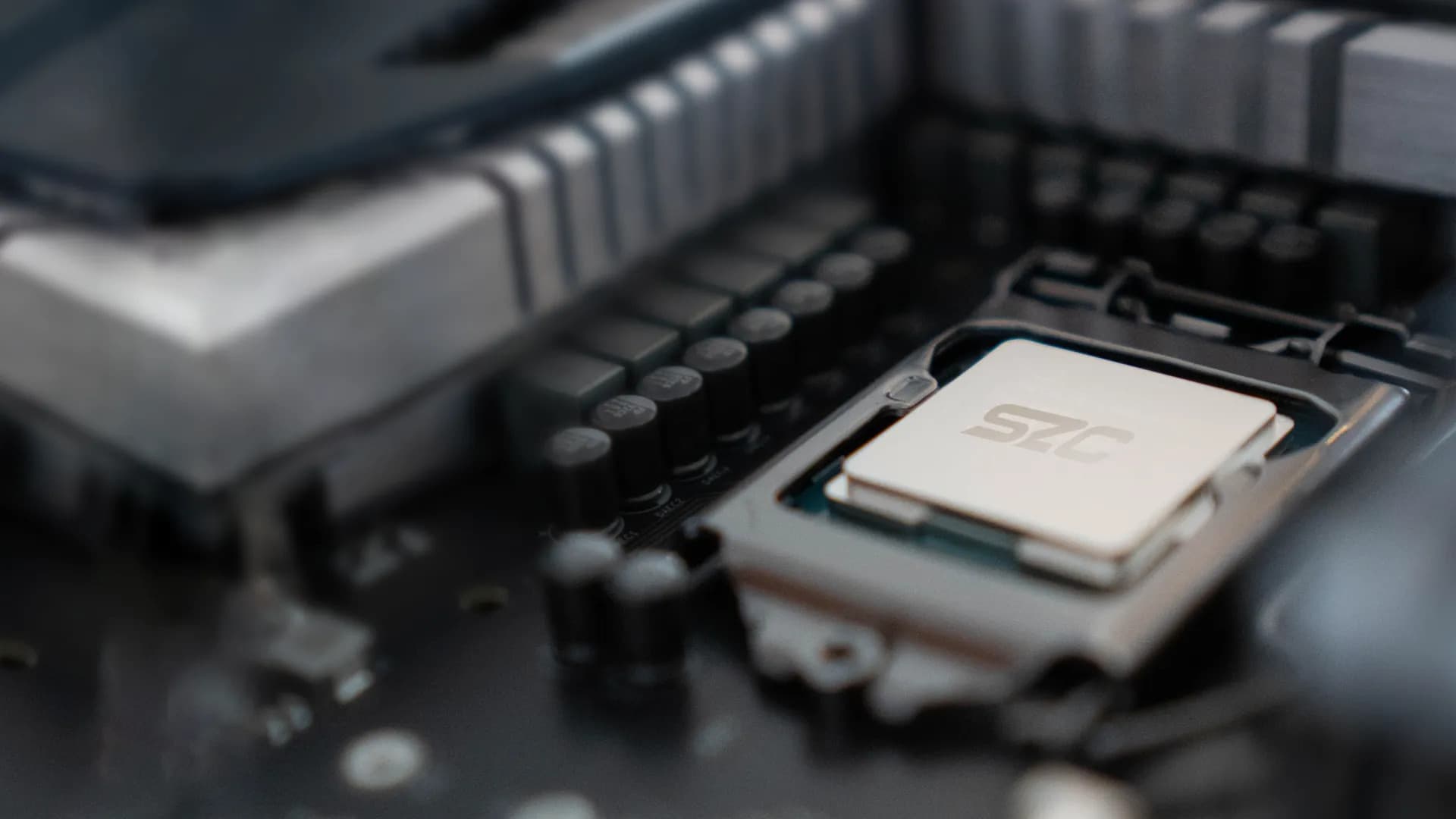

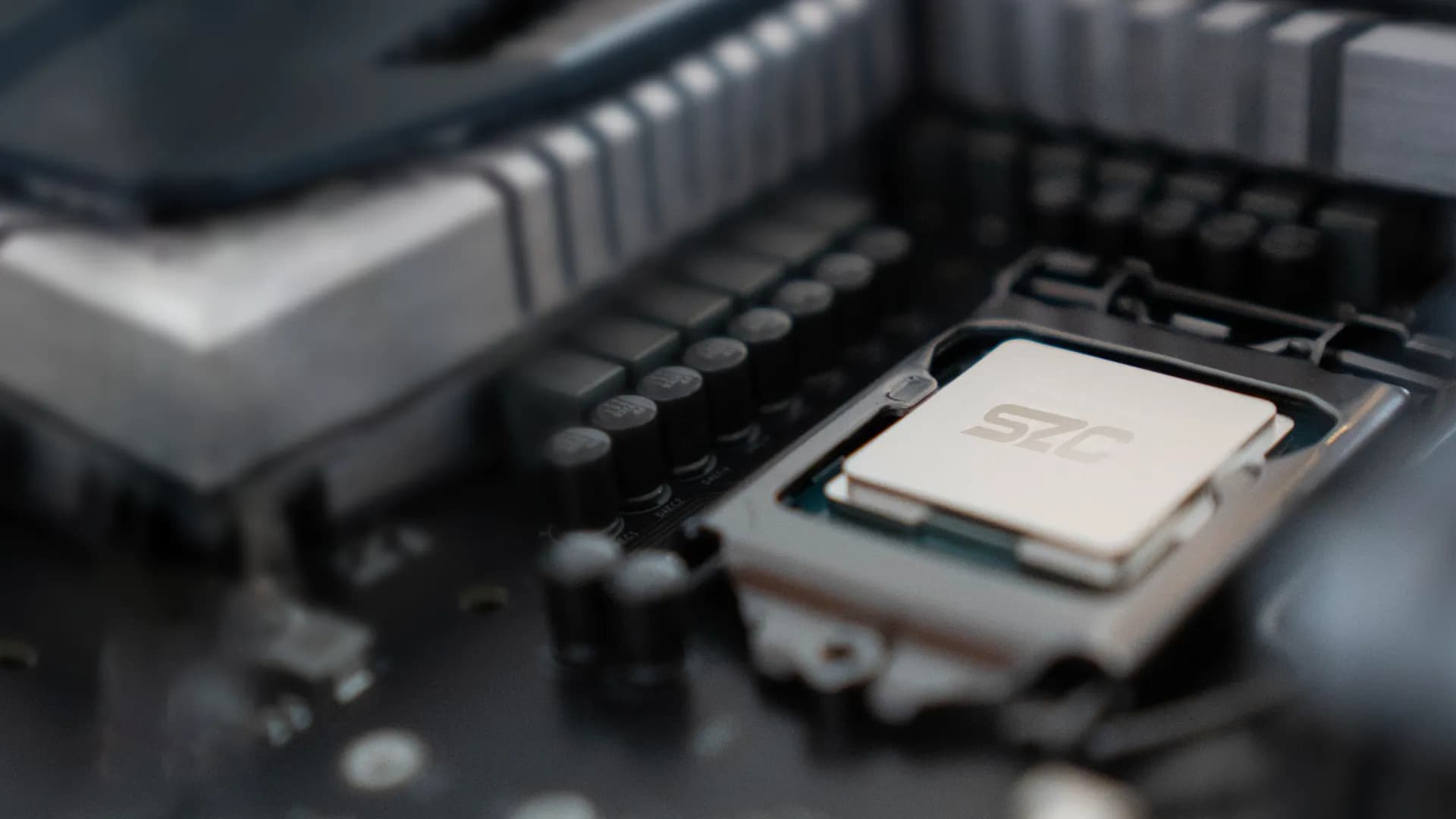

Samsung's move to cut memory chip production reflects the delicate balance between market demand and production capacity in the semiconductor industry. The impact of global economic fluctuations and the complexities within the supply chain echo the challenges faced by even the industry leaders. For more than 20 years, SZComponents has been dedicated to delivering top-tier electronic components, prioritizing unparalleled quality while ensuring competitive market prices. Our commitment lies in the seamless acquisition of the finest components without compromising on excellence. With an unwavering focus on precision and efficiency, we strive to ensure that the right parts reach their intended destination at precisely the right time.

Source: https://www.bbc.com/news/business-65210190